Don't Sunset Affordability: Why Congress Needs to Extend Marketplace Subsidies Now

-1656363832.png)

One of the constructive legacies from the COVID-19 pandemic is the historic improvement in the number of Americans with health insurance. The American Rescue Plan Act (ARPA) made critical investments to make health insurance more affordable for people seeking coverage outside the workplace. However, without swift Congressional action, this legacy could be lost. Congress must renew the temporary subsidies that lowered health care costs and made Marketplace coverage more accessible for millions of Americans.

How the ARPA Subsidies Made the Marketplace More Affordable

ARPA enhanced and expanded eligibility for premium tax credits to help individuals and households enrolled in the ACA Marketplace better afford their monthly health insurance premiums. The law made zero-dollar premium plans available to people up to 150% of the federal poverty level (FPL). It also enhanced premium assistance for higher-income people (150% FPL – 400% FPL). Finally, it expanded eligibility for premium subsidies to people with income above 400% FPL by limiting health insurance premiums to no more than 8.5% of their household income.

Impact of Subsidies

The White House estimates that ARPA Marketplace subsidies provided financial support to 14.5 million Americans seeking coverage through HealthCare.Gov or a State-Based Marketplace while increasing coverage by 21%. According to recent government estimates, more than 90% of the people that signed up for coverage on the Marketplaces received financial assistance, and 4 out of 5 people could find plans that cost less than $10 per month.

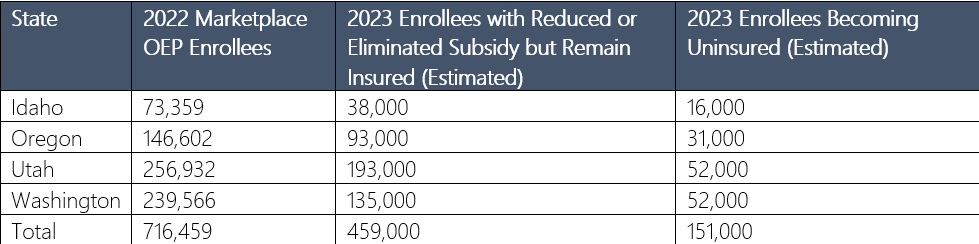

The subsidies have greatly benefited people in Regence’s four-state footprint. The chart below shows the estimated impact in each of Regence’s four states if the subsidies expire at the end of the year.

The expiration of the ARPA subsidies could come as U.S. families struggle with the nation’s highest inflation in 40 years and as 15 million Americans are set to lose Medicaid coverage when the public health emergency ends. According to an analysis by Oliver Wyman, the combination of Medicaid redeterminations and expiring subsidies will result in 5.1 million people becoming uninsured by 2024. Furthermore, the Department of Health and Human Services estimates that nationwide 9 million people will have increased premiums, and 1.5 million will lose subsidies altogether. Coverage losses will disproportionally impact the non-Hispanic Black population, young adults, and people with incomes between 138 and 400% FPL.

On average, Americans receiving an ARPA subsidy saved $700 last year, and if the subsidies lapse, many will see their health care costs increase even more dramatically. The Blue Cross Blue Shield Association developed an online tool to show the financial impact of the ARPA subsidies at www.subsidyestimator.com. For example, four common scenarios.

A 28-year-old Seattle resident making $28,980 (WA minimum wage) would see their annual premium increase by $1,284

A 40-year-old Salt Lake City resident making $33,975 (200% FPL) would see premiums increase by $1,416

A family of four in Portland making $67,500 (U.S. median wage) would see premiums rise by $2,880

A 55-year-old married couple in Boise making $73,240 (400% FPL) would see premiums rise by $12,672

During a time when families are already dealing with increased costs at the gas pump and grocery store, paying thousands more for insurance coverage could be untenable.

Time Is of the Essence

A late extension of enhanced subsidies could create chaos in the open enrollment process for 2023 as plans strain to adjust premiums and process eligibility determinations. Enrollment for 2023 will begin on November 1 of this year. Realistically, the subsidies will have to be extended in August to avoid customer confusion and uncertainty during the open enrollment period this fall.

Furthermore, the expiration of the ARPA subsidies could come during disruptions in the Medicaid market. When the current public health emergency ends, it is estimated that about 15 million people will lose Medicaid insurance. States then will have to redetermine eligibility for the program. An extension of the ARPA subsidies will help mitigate the anticipated coverage losses from that process.

Congress has the unique opportunity to extend the APRA premium tax credits as part of a budget reconciliation package currently being negotiated. Fortunately, we have many Congressional champions of the APRA subsidies in our four-state footprint, including Finance Committee Chairman Ron Wyden, Senate HELP Committee Chair Patty Murray, and coalition chairs like Rep. Suzan DelBene. Immediate action is required to protect millions of people from this looming ACA subsidy cliff, ensure access to comprehensive and affordable insurance, and prevent significant increases in out-of-pocket costs.